How We Work With You – The Process

We believe in getting to know you. Your goals, questions, plans, ideas, worries, and thoughts are critical bits to building the strategies that help you reach the future you envision. You can come to the office or we can come sit at your kitchen table (real or online) for an initial conversation. You will share your thoughts and ask questions as you get to know us. We will explore together to see if how we serve people is a fit for your needs. Not everyone is a fit making it important to be sure we are aligned.

We believe plans (and yes, budgets) are important elements of success. As no less a wise man than Benjamin Franklin is purported to have said: "Failing to plan is planning to fail." Let's build a strategy for success.

If what we do fits what you are seeking, then we build a plan for you, and launch a relationship we hope serves you for years to come. Once we have the strategy, then we work through the mechanics of formally engaging you as a client and opening accounts. Only after we engage with you for services will you pay a fee.

Thoughts on What Makes You and Berkeley Advisors a Good Fit

- You want to focus on what you enjoy most and do best. You'd rather leave the worry about right strategies, investments, changing tax and estate rules and tools, and monitoring to Berkeley Advisors (BAI) where we actually enjoy doing just those things.

- You want someone who is your partner that you can call or email with questions about all kinds of 'money things' when they come up – knowing you will get a prompt answer.

- You value professional advice enough to pay for the expertise.

- You know that nobody (not even the folks at BAI) know what markets will do so you are willing to let a Strategy work despite market ups and downs, economic recessions and good times, and political uncertainty. Your Strategy and Goals are the drivers of the work we do together.

- You are willing to meet at least once every two years – or more often – but at least bi-annually.

FAQs

(Non-Lingo version: Stuff you Want to Ask About)

What is a Fiduciary Obligation?

At Berkeley Advisors, we keep our clients' interest first. The CFP® Code and Standards provides guidance to Certified Financial Planner™ professionals on the duties they owe their clients; we maintain their standards as our own. There are three components to our fiduciary obligation to clients:

- Duty of Loyalty: a CFP® professional must keep their client's interest above their own, avoid or disclose any conflicts of interest, and obtain the client's informed consent.

- Duty of Care: in everything we do, a CFP® professional must act with care, prudence, and diligence regarding a client's goals, risk tolerance, objectives, and financial and personal circumstances.

- Duty to Follow Client Instruction: a CFP® professional must adhere to the terms of a written client agreement and follow all directions from a client that are reasonable and lawful.

Source: CFP® Code and Standards

What is a Certified Financial Planner™ professional?

The CFP® Board has established a training and competence set of standards in the financial planning industry that demands practitioners earn the right to use the Certified Financial Planner™ designation or the CFP® marks, including educational requirements, thousands of hours of practical experience, and a passing score on a challenging national exam. You can read about the requirements to become a CFP® professional here.

Why is this important? We believe that holding ourselves to the highest industry standard works for you. We want our clients to be assured that we're working for them and that we prioritize their interests. After all, you're the reason our firm exists.

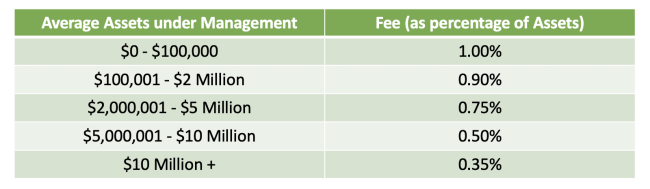

What does it cost to work with Berkeley Advisors?

Fee-Based Planning is a compensation structure based typically on an agreed upon fee for a service. This is most frequently represented by an annualized Assets Under Management fee (see our table below). We charge a monthly management fee on the average balance of your account over the past month, which over the course of a year corresponds to the table below. For example, in early May we will charge a management fee for the average daily balance of your account in the previous month of April. The prior month's average balance of all of your accounts is combined to reach the lowest fee level applied for any given month.

We use the term “fee-based” and not “fee-only” because at Berkeley Advisors we can offer certain life/disability insurance solutions that pay a commission. We disclose any potential compensation from such arrangements prior to reviewing or recommending them with clients. This potential compensation does not influence how or when these services are positioned with clients.

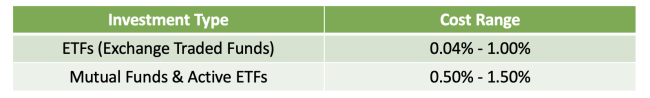

What other investment costs might I pay?

- Berkeley Advisors uses a range of investments, including equity and bond mutual funds and ETFs, each of which carries its own management fee. We disclose the costs of participating in those funds to clients prior to investing and in regular reviews.

What is the minimum amount I have to invest?

- We don't set a minimum.

What is Berkeley Advisors not?

- We are not a firm that pushes clients into a fixed set of portfolio designs. We are not too busy to answer your questions. We are not going to sell you products or services that generate fees but do not meaningfully improve your financial health or progress towards your goals.